Two pictures should tell this story.

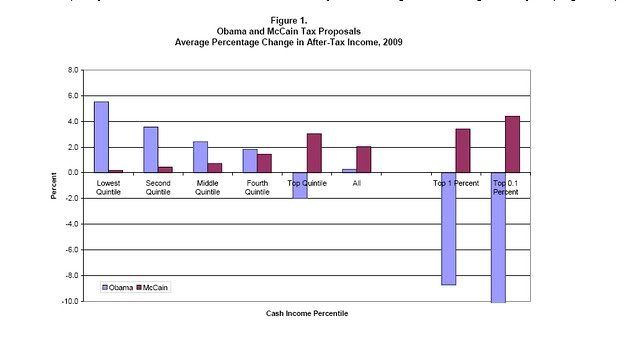

The first is from a recent kavips post, detailing the impact of Senator Barack Obama's tax plan for taxpayers in various increments of income.

It seems to show exactly what the Obama campaign has been claiming all along: 95% of all Americans would do better under his tax plan.

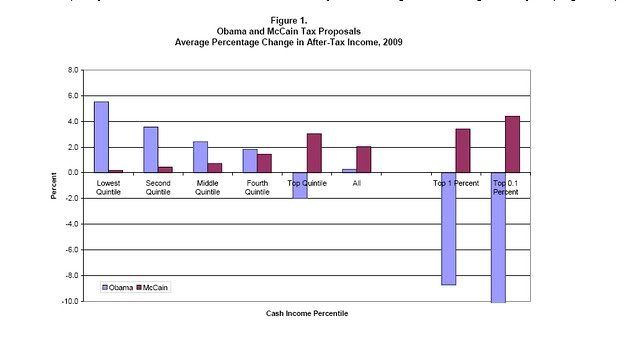

Now here's one from Fausta, that also shows what would happen at each income bracket regarding marginal tax rates under the Obama plan. This one seems to show what Senator John McCain has been saying throughout the campaign: the Obama plan actually raises taxes on a lot of middle class families:

Both of these tables can be backed up by dense articles of explanatory economics, and each could be picked apart--but that's not my point.

My point is this: most people read the headline [from a source whose ideology they are already predisposed to trust]; glance at the table, and then skim the opening paragraph that either claims exhaustive analysis proves Senator Obama is a savior or a liar.

One in a thousand will probably read the entire article, but won't every wonder if possibly the writer could be biased.

One in ten thousand will know that his/her source is telling him/her exactly what he/she wants to hear, but will take the information as useful talking points to employ around the office or at dinner parties.

One in one hundred thousand will be intellectually honest enough to go check for a contrary view of the plan, but at least two-thirds of these will read the other opinion and realize, "I have absolutely no idea which of these sources is correct," and will tend to fall back on a favored commentator to break it down.

Assume 140 million voters. If one/third of one in one hundred thousand voters actually (a) takes the time to investigate the differences between the two pictures; and (b) either knows or learns enough to distinguish between them, that means that 1,400 voters will try to figure it out, and only 467 voters will succeed.

467 voters out of 140,000,000?

OK, I made up the one in a thousand stats, and so forth, because I don't have any hard numbers to use. But I'm willing to bet that I'm not that far wrong. Let's assume I am, and that one in ten thousand people actually takes the time to do all the work and reach the right conclusions: that's still only 14,000 voters.

In other words, the votes of people who actually take the time and have the ability to understand the differences in the two presentations of Senator Obama's tax plan are at best one-one-hundredth of one percent of the total.

Which is ... inconsequential.

Maybe I'm under-estimating the intelligence and attention span of the American people, but based on the people I talk to in person and encounter in the blogosphere, I don't think so.

For every cassandra who can actually penetrate the fog, I think there are really 9,999 more liberals and conservatives who either cannot or will not.

Regardless of whether they vote Republican or Democrat (or even third party), there's a technical term for that: fucking lemmings.

We deserve the government we get.

The first is from a recent kavips post, detailing the impact of Senator Barack Obama's tax plan for taxpayers in various increments of income.

It seems to show exactly what the Obama campaign has been claiming all along: 95% of all Americans would do better under his tax plan.

Now here's one from Fausta, that also shows what would happen at each income bracket regarding marginal tax rates under the Obama plan. This one seems to show what Senator John McCain has been saying throughout the campaign: the Obama plan actually raises taxes on a lot of middle class families:

Both of these tables can be backed up by dense articles of explanatory economics, and each could be picked apart--but that's not my point.

My point is this: most people read the headline [from a source whose ideology they are already predisposed to trust]; glance at the table, and then skim the opening paragraph that either claims exhaustive analysis proves Senator Obama is a savior or a liar.

One in a thousand will probably read the entire article, but won't every wonder if possibly the writer could be biased.

One in ten thousand will know that his/her source is telling him/her exactly what he/she wants to hear, but will take the information as useful talking points to employ around the office or at dinner parties.

One in one hundred thousand will be intellectually honest enough to go check for a contrary view of the plan, but at least two-thirds of these will read the other opinion and realize, "I have absolutely no idea which of these sources is correct," and will tend to fall back on a favored commentator to break it down.

Assume 140 million voters. If one/third of one in one hundred thousand voters actually (a) takes the time to investigate the differences between the two pictures; and (b) either knows or learns enough to distinguish between them, that means that 1,400 voters will try to figure it out, and only 467 voters will succeed.

467 voters out of 140,000,000?

OK, I made up the one in a thousand stats, and so forth, because I don't have any hard numbers to use. But I'm willing to bet that I'm not that far wrong. Let's assume I am, and that one in ten thousand people actually takes the time to do all the work and reach the right conclusions: that's still only 14,000 voters.

In other words, the votes of people who actually take the time and have the ability to understand the differences in the two presentations of Senator Obama's tax plan are at best one-one-hundredth of one percent of the total.

Which is ... inconsequential.

Maybe I'm under-estimating the intelligence and attention span of the American people, but based on the people I talk to in person and encounter in the blogosphere, I don't think so.

For every cassandra who can actually penetrate the fog, I think there are really 9,999 more liberals and conservatives who either cannot or will not.

Regardless of whether they vote Republican or Democrat (or even third party), there's a technical term for that: fucking lemmings.

We deserve the government we get.

Comments

After making the assumptions that 1) Obama gets elected, 2) He wasn't lying about how he intends to change the tax structure, 3) No crisis will come along and force him to alter his plans, 4) He actually gets Congress to pass the bulk of his program without adding a lot of amendments that alter it in unpredictable ways, and 5) the projections & demographics it was based on by some miracle turn out to be mostly correct; it starts to look like there plenty of more productive ways that I could spend my time.

It's not as if my vote matters anyway--I live in Delaware and our 3 EV are going to Obama & Biden no matter how I vote or how the 10-1000 people that I can influence to some significant degree vote.

I don't think it represents what you think it does.

I fall right into this range, with different but similar enough circumstances, so of course I know how my taxes work out.

And I will be the first to reluctantly admit to you that I make out like a bandit at tax time. I even feel a little guilty about it. As much as it would irk me to lose out on my refund, I think this might represent a correction.

And to be honest, it WOULD encourage me to work harder....to get out of my weak household salary range, if I'm no longer making a profit from it.

Darn. So darn, but I'm still in the tank for Obama.

The key is the word "marginal" What is a marginal tax rate? I had to look it up, too..

Not to break it to anyone, but all of us have been paying higher marginal tax rates for all our lives...

It can be explained this simply. The more money you make with less taxes taken out, the less your marginal rates will be... The more money you make with more taxes withheld, the higher your marginal rates will be.

Obama will raise taxes on those making over $250,000, and reduce taxes on those making less.

The top chart is correct, and the second chart is devious in that it attempts to make you believe something that isn't true, because most of us do not know what a Marginal tax rate is.....

That makes both graphs true.

I understand the difference between the two; that wasn't my point.

If you consider it, using the antecedents of your hypothesis, that would make 30 or some of the 467 nationally most astute citizens, hailing from our little fair state...

Which with a broad brush, would raise our intelligence level much higher than the rest of our nation.

:) A noble achievement to be sure..

And all from one little comment... at the end of a great post.... wow.